Consumers, perhaps more than ever, are focused on experiences. And while golf certainly qualifies as an experiential activity, a getaway golf trip – with family or friends – takes that experience… to another place.

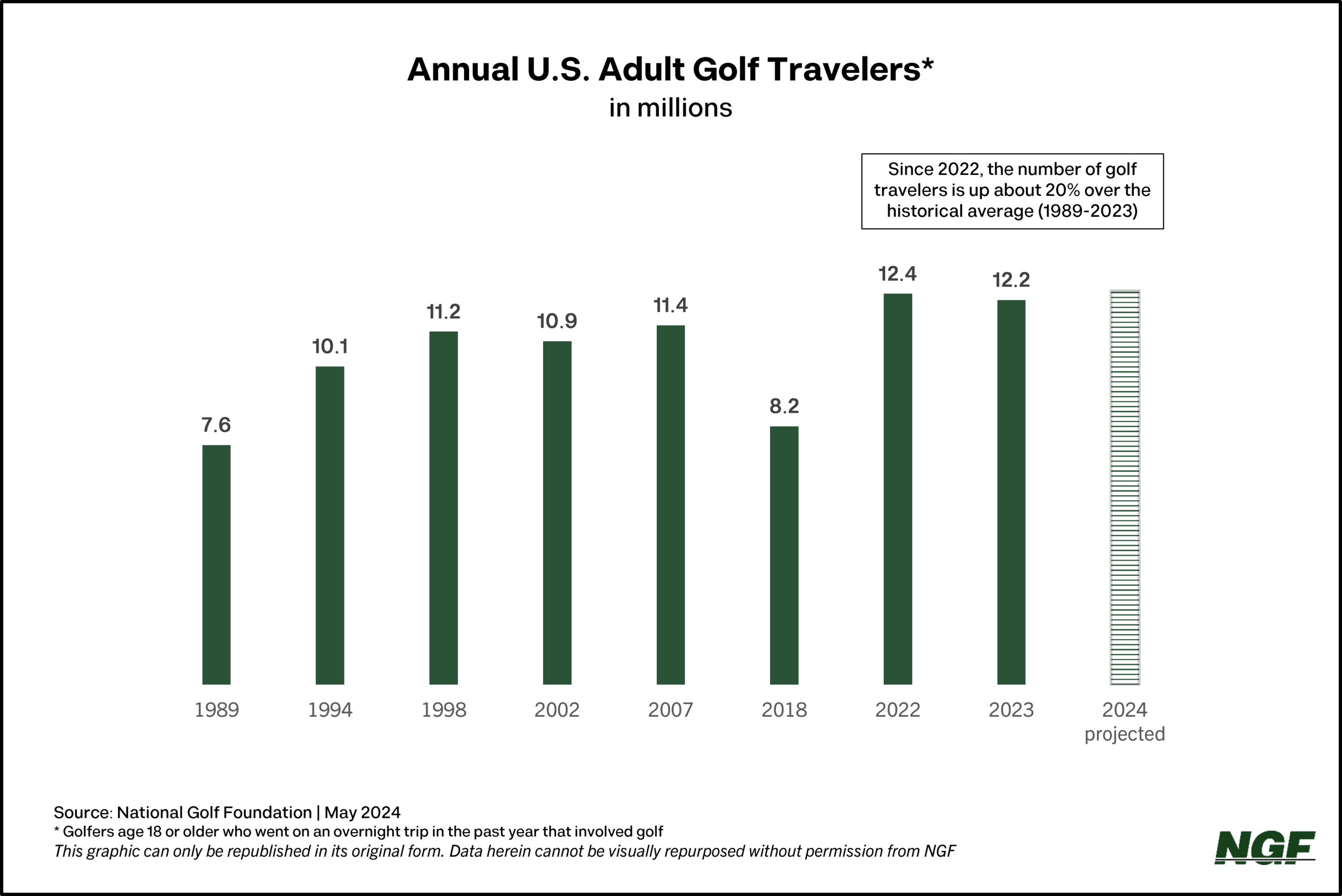

Last year, approximately 12.2 million U.S. adults took a golf trip*, close to the all-time recorded high set a year earlier and 20% higher than the annual average of our measurement years from 1989-2023.

Based on NGF’s consumer surveys and year-to-date figures, there’s no sign of let-up when it comes to golf wanderlust either. The number of golf travelers in 2024 are projected to exceed 12 million for the third straight year. Conversations with golf resort operators and management companies substantiate heightened interest as well as strong early-season guest momentum and/or pre-bookings.

TSA checkpoint numbers at U.S. airports bolster these findings, with year-to-date throughput numbers on broader travel running ahead of each of the past three years and the pre-pandemic years as well.

Golf tourism overall is the second-biggest economic driver in the industry behind only facility operations, with golfers generating over $31 billion in travel-related golf expenditures within the U.S.

The post-pandemic increases in participation and play across the golf landscape have extended to golf tourism, which had been one of the sectors of the industry most adversely affected by the onset of the coronavirus in spring 2020. This momentum has been further amplified by the exposure and buzz accompanying the development at some of the game’s most high-profile properties.

The Pinehurst Resort in North Carolina, aka the “Cradle of American Golf,” recently debuted its 10th regulation course (and 11th overall) ahead of hosting the U.S. Open yet again in June. Bandon Dunes, which ushered in a new era of destination golf on a remote stretch of Oregon coast, this year opened a new Par 3 course – it’s seventh overall – in concert with the resort’s 25th anniversary. Streamsong (Florida) and Boyne Resorts (Michigan) are also debuting new short courses this year as a complement to their multitude of championship courses, while Sand Valley (Wisconsin) is unveiling the fifth course in its growing portfolio and the Cabot brand introduced three completely redone courses at Citrus Farms in Florida, with a fourth soon to follow.

While these popular multi-course destinations are some of the most prominent golf getaways in the U.S., they represent just a select niche among the nearly 1,200 golf facilities tied to resorts or resort/real estate properties nationwide. Most are regional draws rather than national, pulling in road-trippers from in-state or surrounding states – in some cases for an overnight stay that involves golf, in others for multi-day stay-and-plays.

And the numbers show more golfers are pursuing these getaways than ever, big and small.