Golf is a bit unusual in that the dream scenario for many serious players is having your favorite course, grass freshly cut, and no other players on the property. That’s a fantasy not well-aligned to the success of the business.

The reality is that a greater number of golfers have played more rounds over the past several years and this means U.S. golf courses – broadly speaking — are busier than ever.

After all, while there are about 4 million fewer golfers today as there were during the high-water mark in 2003, there are also about 2,000 fewer golf facilities than two decades ago.

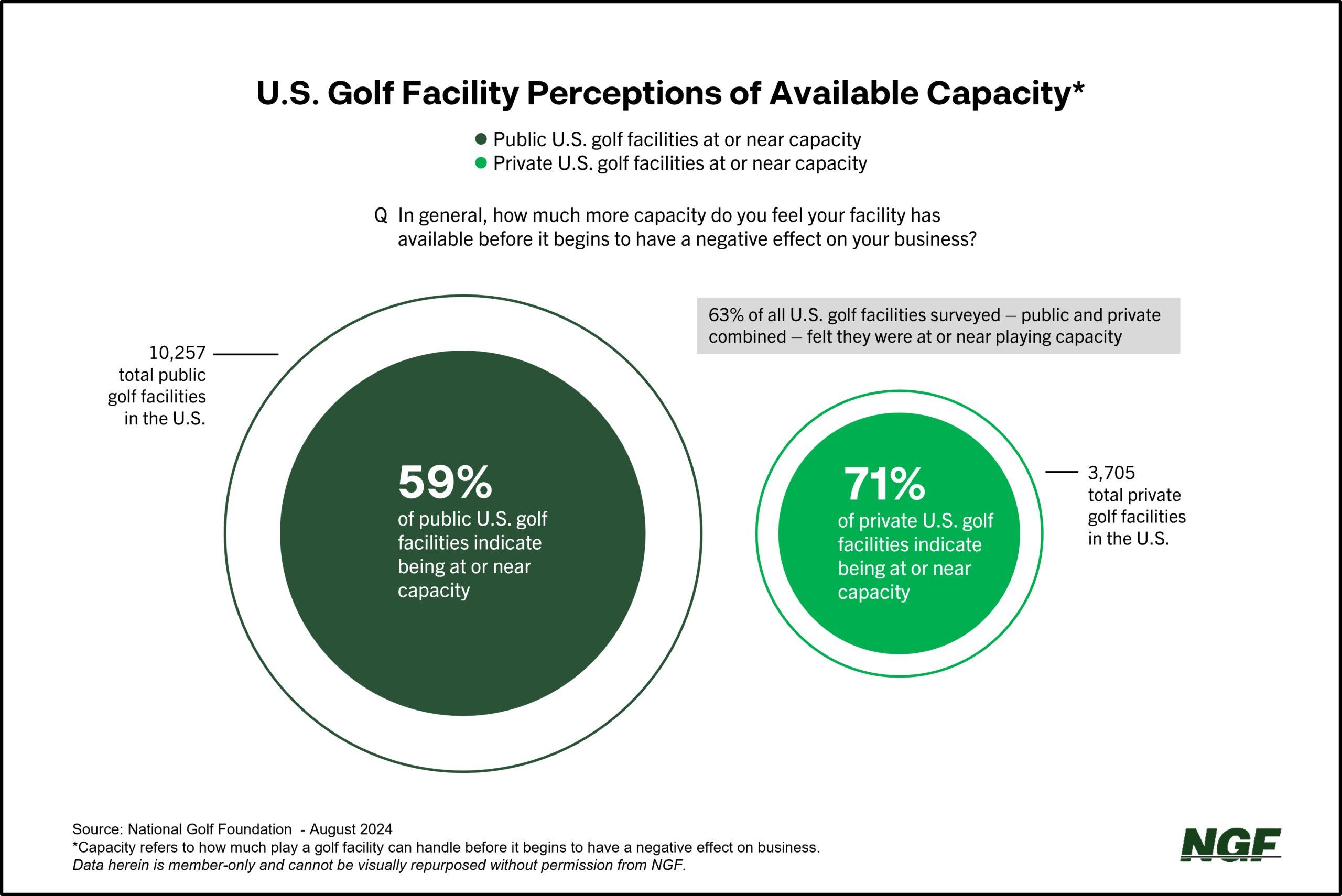

In a recent survey of golf course operators, almost two-thirds indicated they were “at” or “near” playing capacity.

Now it’s important to define what exactly “capacity” constitutes.

It doesn’t mean that daily tee sheets are completely full. In this context, NGF is defining capacity as how much more play a facility can handle before it begins to have a negative effect on business – whether that’s due to staffing challenges or an overtaxed golf course that leads to poorer playing conditions and less satisfied customers.

There’s a tipping point in almost all businesses between increased demand and being able to deliver a quality product. The hotel business has similarities to golf with room availability and guest capacity. Hotels being “at capacity” doesn’t necessarily mean all their rooms are sold out. The same is true with golf and tee times.

Private clubs, which account for approximately one-quarter of overall U.S. golf supply, are more likely to indicate they’re at or close to capacity because of their need to meet members higher expectations of service. But almost 60% of public operators in our survey suggested they’re around that subjective threshold.

The byproduct of increased golf engagement is that facility financial health measures remain up significantly compared to recent pre-pandemic years. Overall, participation and play surges dating back to 2020 have been a significant positive for the golf course business.

On a national level, year-to-date play continues to trend ahead of 2023, when there were more rounds played at U.S. golf courses than any other year in history.

Perhaps not surprisingly, more than half of golfers indicated in a recent study that those coveted weekend rounds are “a lot” or “a little” more challenging to book than they were in recent years.

What’s encouraging is that greater work flexibility seems to be helping increase opportunity. More than 40% of golfers suggest rounds on weekday mornings or afternoons are at least a little easier to book, in part likely due to hybrid work schedules and work-from-home options.

So, does golf have a potential capacity problem?

It depends where you are and who you ask, but with total play at or close to record levels with no signs of declining demand, there’s a reason new course development – while still limited – is at its highest level in a decade. Particularly in the private club sector. More on private golf supply can be found in this accompanying Full Shots story.

You can count on NGF to keep a finger on the pulse of golfers and operators when it comes to play levels — public, private, and overall.