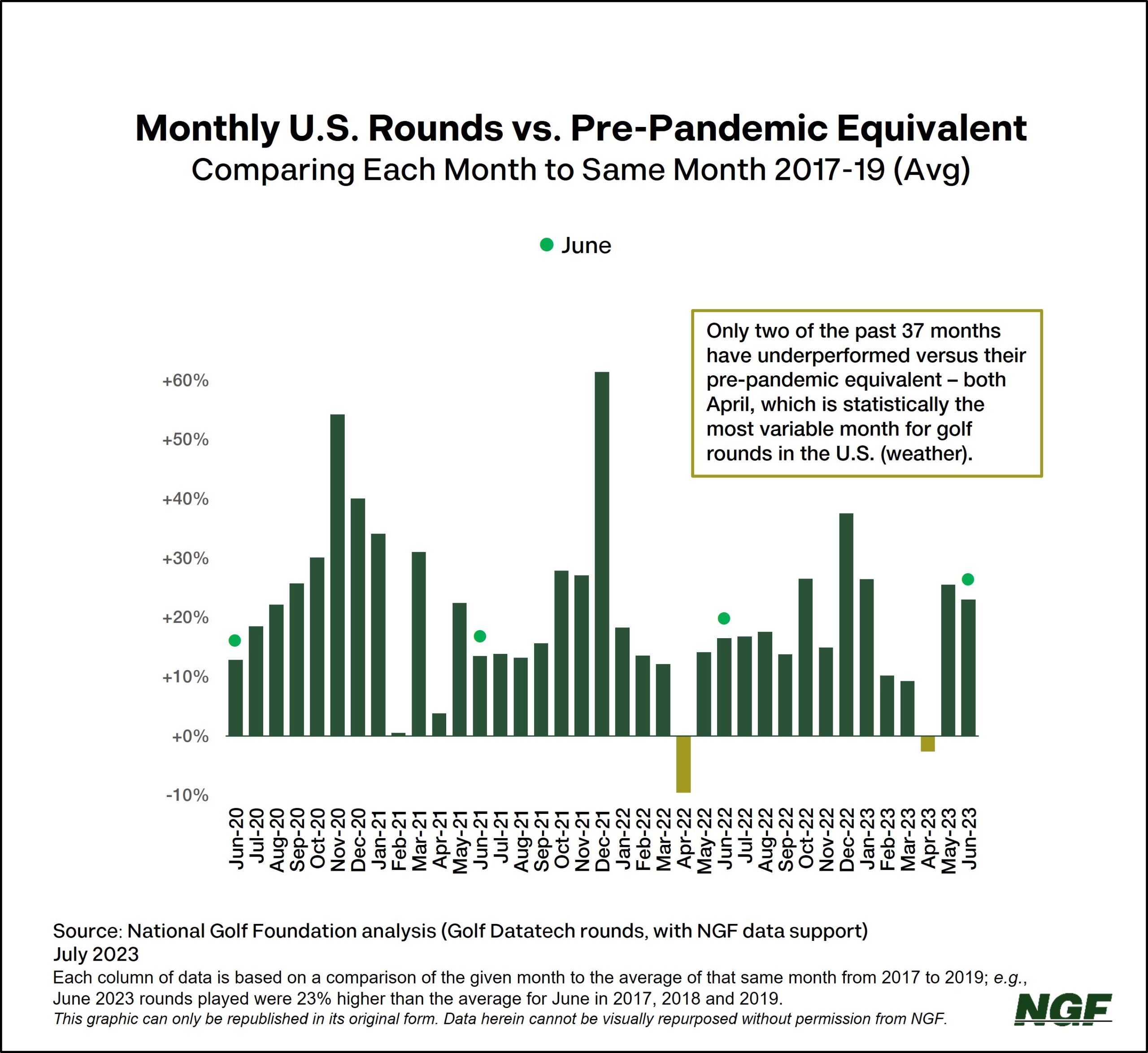

That’s now three straight months of meaningful year-over-year gains in rounds played at U.S. golf courses (April +7.8%, May +10%, June +5.5%), as demand for our core product continues to hold strong in an apparently slowing economy.

Still too early to declare a “new normal?” You be the judge:

- Since Covid-related restrictions on golf were lifted, 35 of the past 37 months have outperformed their pre-pandemic equivalents (using 2017-19 monthly averages for comparison); the lone underperformers were both in April, which is statistically the most variable month for rounds in the U.S. (weather).

- Perhaps even more compelling, 24 of those 37 months topped their peak equivalent going back to 2007; only 7 of the other 13 finished more than 5% below their 13-year peak, and all were lower-volume months (Feb, Mar, Apr and Nov) where seasonality, temperature swings and extreme weather events can distort true golf demand.

- Entering July, we are less than a single percent behind the record-setting pace set at midpoint 2021, and more than 15% ahead of the pre-pandemic midpoint (again, using a 2017-19 average).

I suspect someone on the outside looking in would have made a “new normal” declaration months ago, but cautious optimism has become the guiding principle for forecasting and strategy planning in today’s turbulent, ever-changing times.

Certainly there’s no compelling evidence that consumer appetite for “green grass” is abating. If anything, it continues to intensify and spread (did you see country music megastar Luke Combs challenge global icon DJ Khaled to a round of golf?).

And yet, for an activity that relies on money and weather, appetite isn’t always enough. With the Fed still trying to quell inflation and Americans sweating through this unprecedentedly oppressive July, the short-term outlook for rounds should probably assume some softening (we’d note that online search popularity for golf balls recently dipped below 2022 levels for the first time).

Longer-term, as golf continues to invade popular culture, modernize its brand and grow its product portfolio – thus becoming increasingly competitive in an increasingly competitive marketplace – our expectation is for things to continue trending, more or less, as they are.

Stay cool out there.