There’s an impression not much development is happening in golf. It’s clearly not the case. Course designers are busy with hundreds of renovations and course resurrections (where a previously closed course is brought back to life) along with a smattering of new courses. Add to that the growth of non-traditional golf entertainment facilities and you’ll recognize overall golf supply is not standing still.

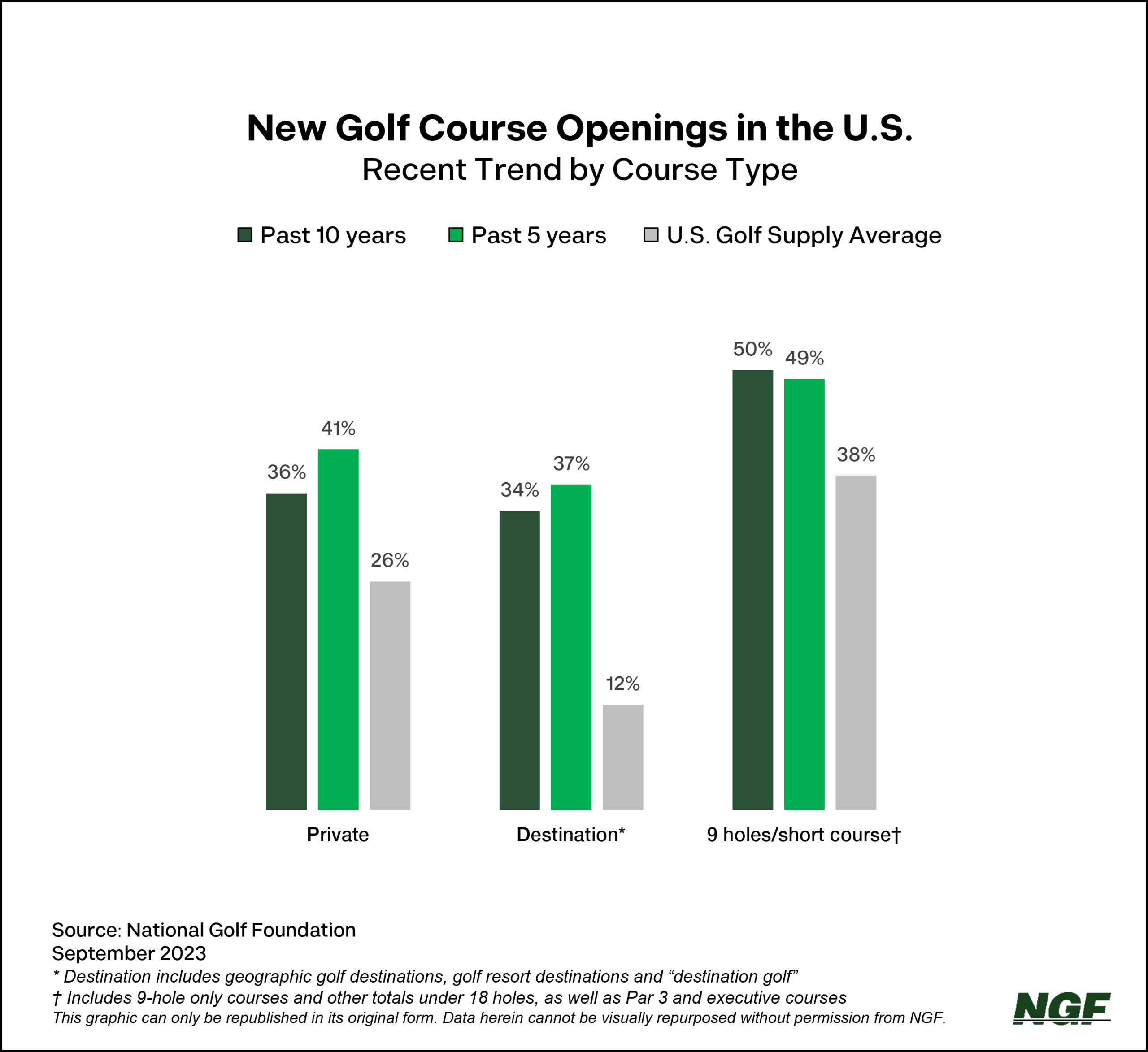

When it comes to traditional golf courses, what’s being built today is different than during the development boom of the late 1990s and early 2000s. The past 10 years have seen a disproportionate number of high-end private clubs, the rise of destination golf, and the emergence of upscale short courses.

Destination Golf

The term “Destination Golf” is relatively new to the golf lexicon and has almost become a generic name used to describe a place where you “go away” to play golf. Here at NGF we break down “Destination Golf” into two distinct categories:

Golf Destinations, or areas defined by geography, are well-known for great golf but have plenty of other offerings – things to see and do, and many places to eat and stay. Think Myrtle Beach, Pinehurst, Palm Springs and South Florida. Outside the U.S, it’s places like Southwest Ireland, Scotland and Vietnam.

Then there’s Destination Golf. These properties are golf-specific, making the game the prime reason for visiting. You’re there to play golf and be with friends. Sand Hills ushered in this movement – opening in 1995 in rolling and remote western Nebraska – and there has been slow, steady growth in this category over the past three decades. Getaways like Bandon Dunes, Cabot, Sand Valley, Streamsong, and Gamble Sands followed in the resort space. On the private side, there are places like the Ohoopee Match Club, Ballyneal, and more recently Tepetonka being built a couple hours west of Minneapolis.

Short Course Revival

Recently, there’s been somewhat of a rebirth of shorter courses. Compared to the 1990s, we’re seeing increasing interest in and a move toward the development of ‘less than regulation length’ golf facilities. These newer 9-holers, Par 3s and executive-length courses differ from their older relatives in that they’re of generally better stock: from professional design to higher quality turf and conditioning, and often higher green fees.

Looking Ahead

We don’t expect overall supply of traditional golf courses to change that significantly over the next five to 10 years. We’ll continue to see golf courses sold for redevelopment as some owners recognize a higher-and-better use for their land – not to mention a nice payday. Meanwhile, new courses will continue to open, and look a little different than in past years.

At the same time, we don’t foresee any slowdown in the development of non-traditional golf facilities. Many operators see ‘white space’ in this category and plan for aggressive growth over the next 5+ years. This is good for the traditional game, as our research has shown these facilities are incubators for traditional green-grass golfers.

Golf facility development today is very different from the real estate driven model that fueled the expansion of supply in the 1990s. It’s no boom, but we’re seeing better traditional golf as a result of the new courses, reconstructions and renovations that have improved the overall quality of supply the past 10 to 20 years, along with the introduction of exciting new venues where the game is being introduced to the next generation of golfers.