Despite the volatility surrounding the state of the American consumer these days, those who track these things broadly have projected another strong holiday buying season. The National Retail Federation (NRF) forecasted spending to swell between 3% and 4% over 2022, which so far appears accurate, if not underestimated, based on reports of e-commerce jumping 8% during the critical five-day run from Thanksgiving through Cyber Monday.

Closer to home, NGF research revealed that 87% of Core golfers were planning to spend as much or more on holiday gifts this year – $934 on average, which is about 50% more than the typical American shopper ($620). Roughly half of Core golfers, by the way, say that golf gifting (for self and/or others) is a regular part of their holiday enjoyment, and essentially that same proportion were expecting to buy golf-related items this year as well.

So, how’s it playing out? Well, more or less as golfers anticipated. One of the national golf retailers we spoke with reported a strong holiday weekend where in-store and online sales both outperformed their 2022 comps, including a best-ever Black Friday.

But the question of whether golf-specific (and broader consumer) spending will hold steady this holiday season, and beyond, may be in some ways less important than the question of where the dollars are going.

At a high level, we’re seeing a shifting composition of consumer spending, from goods to services, which NRF predicted would define holiday sales, and economists more generally note as a post-Covid trend, where people, younger people especially, go back to prioritizing “experiences” over “stuff” – like leisure travel, which continues to be an optimistic economic outlier (Sunday was the busiest day ever at U.S. airports).

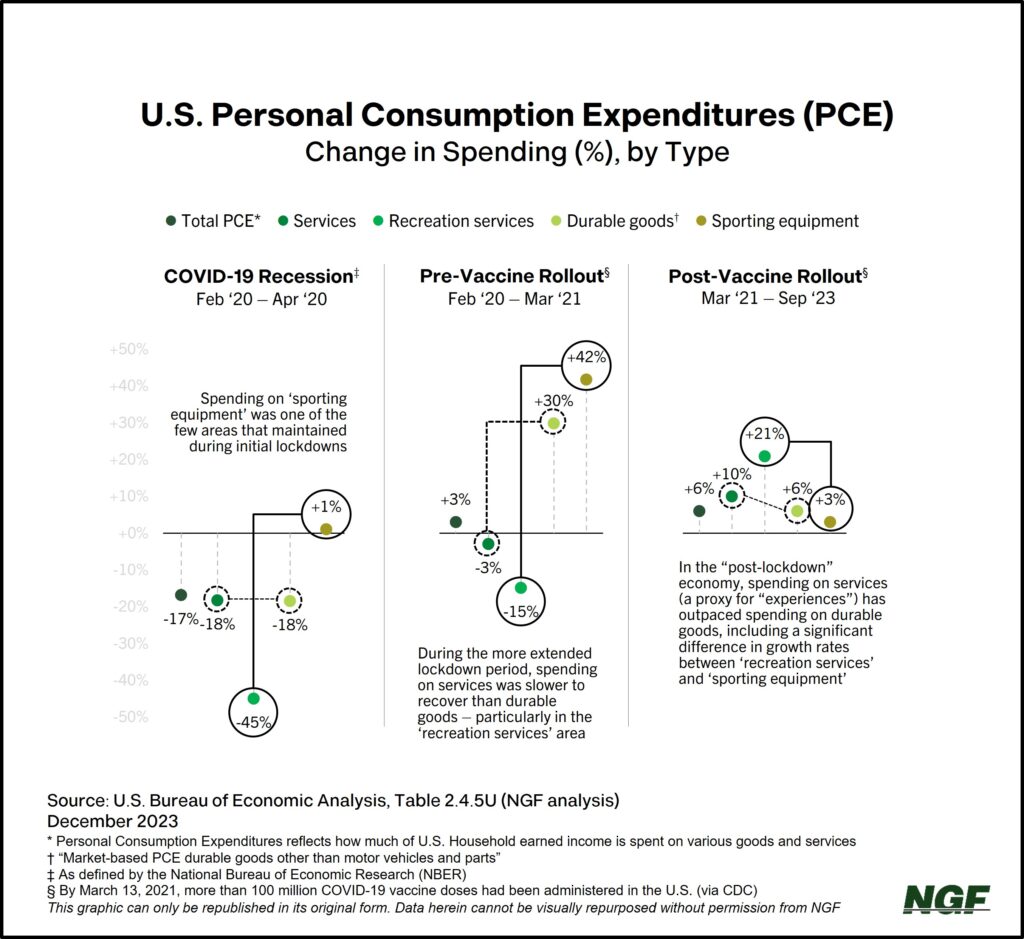

The chart below highlights this shift. Our team looked at 44 months of U.S. personal spending data, which reveals a services-over-goods trend since March 2021, especially when we compare ‘recreation services’ to ‘sporting equipment.’

Consider trends in our own industry, and the fundamental distinction between ball and club sales – a proxy of sorts for “experiences” versus “stuff.” Since March 2021, wholesale shipments of golf ball dozens, using a 12-month rolling average, are up 29%, while shipments of golf clubs are up 4%.

There are multiple ways to interpret these trends, and certainly many possible implications for businesses both in and outside of golf. But the simplest takeaway? Follow the money.