One of the byproducts of golf’s pandemic-fueled resurgence has been an uptick in course construction.

It’s important to note, however, that the U.S. isn’t in the early stages of another building boom. The best-supplied golf market in the world is still seeing more course closures than new openings.

But landowners and developers who were sitting on the sidelines for a while are finding opportunity in certain markets that can support it. Consider that this year’s new openings were heavily weighted in states like Florida, Texas and South Carolina.

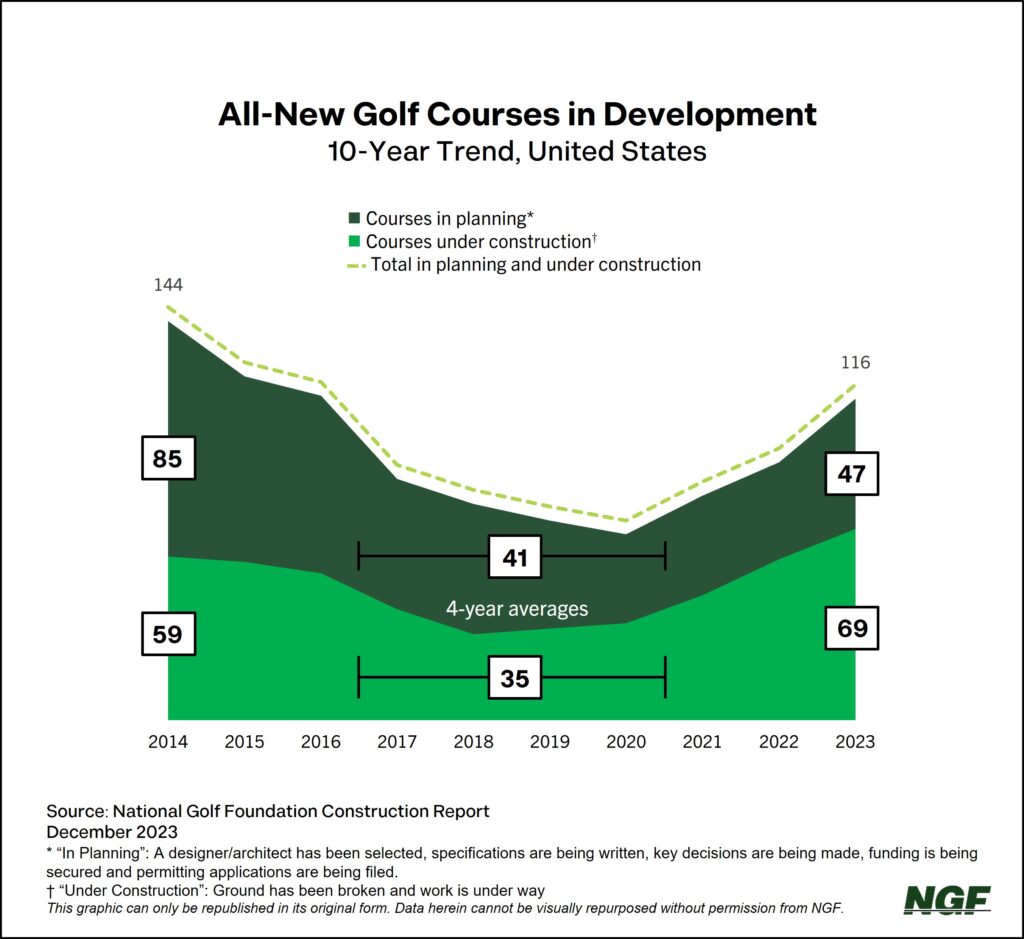

Nationwide, NGF is currently tracking 69 new courses of varying lengths and type under construction, and another 47 that are in planning (see definition below.) When it comes to courses actively under construction, the current count is a far cry from the 400+ that were being built two decades ago, but almost double the recent three-year pre-pandemic average.

NGF members interested in learning more can purchase our Construction Report, which tracks projects from the planning stages to opening day. This year, there have been more new openings in the U.S. than any time in more than a decade, some of which you can read about in this Spotlight sidebar.

The figures above pertain specifically to all-new courses, whether it’s an addition to an existing course or a ground-up project. There’s even far greater investment across the industry in the form of ongoing improvements at existing golf facilities – from renovations and restorations to full rebuilds.

When it comes to current new course development specifically, there are some marked differences:

- About two-thirds of brand-new course projects are private clubs. By comparison, private facilities account for about 25% of the national supply.

- About two-thirds of new course additions are at public facilities.

Once the year-end numbers are finalized next month, members will be able to find more in NGF’s forthcoming Facilities and Golf Industry (Graffis) reports.