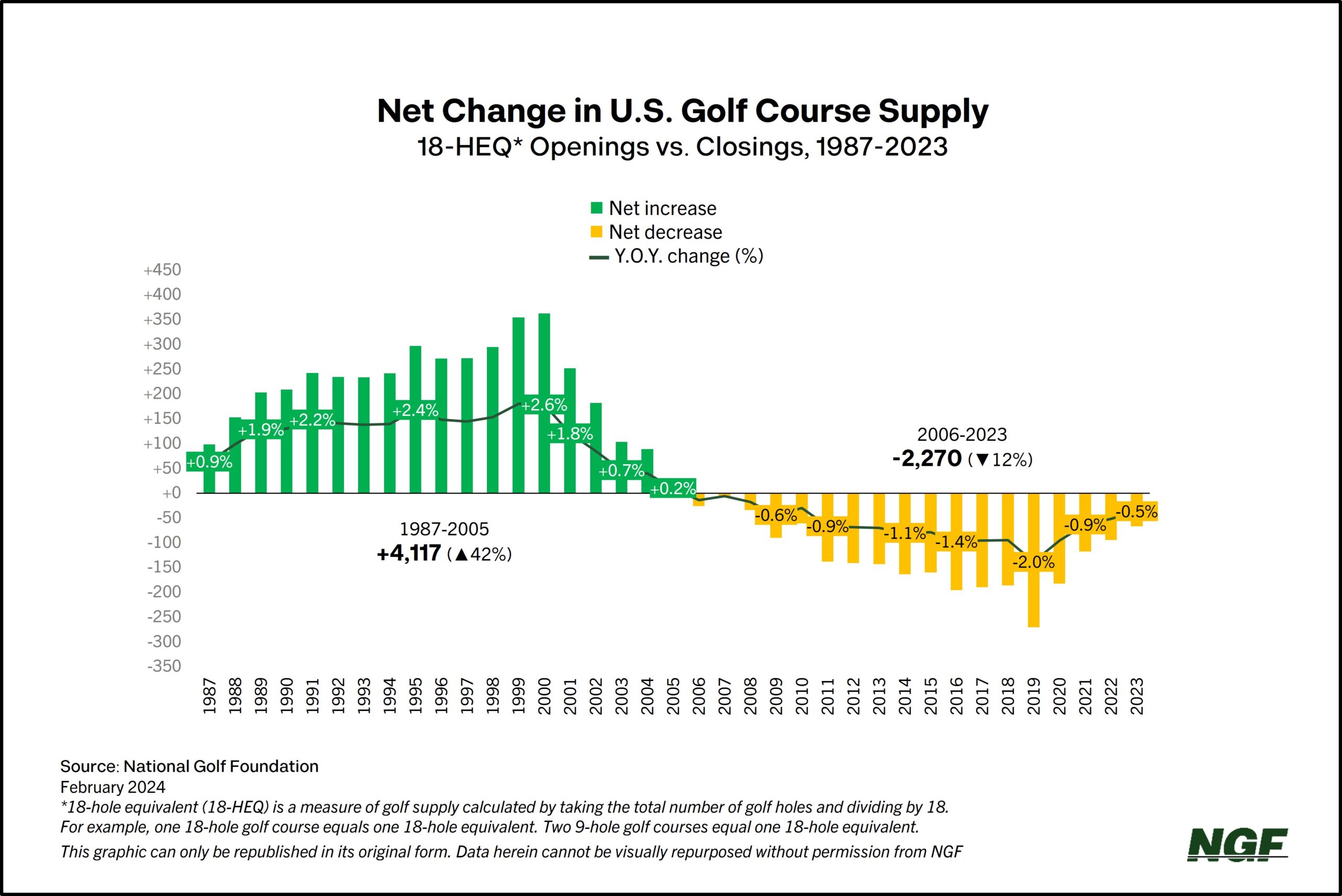

Golf course closures last year came in at their lowest figure in almost two decades.

There were approximately 90 golf course closures in the U.S. last year (as measured in 18-hole equivalents*), resulting in less than 0.5% being trimmed from the nation’s total supply. That’s an indication of stability in golf’s supply/demand relationship.

Last year’s closure total was about one-third of the record number of U.S. course shutdowns in 2019, prior to the pandemic. There were also more new course openings last year (still pretty few) than at any time since 2010 — 24 18-HEQ that encompass 34 projects. Some are noteworthy bucket list courses and others less traditional with 6, 7 or 10 holes.

But because the closure of golf courses is a topic of frequent interest… and frequent misinterpretation… here’s added context:

Closures are inevitable. Businesses come and go in every industry. When a restaurant closes in a community, most residents don’t conclude that “people just aren’t eating out anymore.” Golf course closures just hit differently. The loss of a local golf course generates conversation, as it can often be more impactful than the loss of a local bistro or store.

Given the sizeable footprint of a golf course, there’s natural concern about the potential of seeing so much green space replaced by commercial or residential real estate. There’s also the loss of community that a particular course provided in its area, along with the possible elimination of history depending on the age or architecture of a property.

But we’ve long maintained course closures aren’t a reflection of golf’s popularity or a proxy for the game’s health.

Golf is primarily local. Micro economies and customer needs drive change, especially relative to the balance of supply and demand. The 20-year course building boom created more competition in many major markets, and the quality of golf (and also price) typically increased. Some less desirable “stores” closed and, in more recent years, closures have more commonly been the result of so-called “higher and better use.”

On a macro level, course closure counts can provide insight into the national supply-demand balance.

While we’ve highlighted recent surges in participation and play, this is where we offer a reminder that the U.S. is exceedingly well supplied, with more golf courses than Starbucks or McDonald’s locations – nearly 16,000 in total.

With the above background, it’s notable there were fewer course closures in 2023 than any year dating back to 2004, prior to the Great Recession.

Closures will likely never go to zero. Local competitive pressures don’t go away, and in other instances, long-time owners will have selling opportunities as a lucrative exit strategy given the existing demand for land. It’s why we’ve long said – when it comes to golf course acreage – sometimes “the dirt is worth more than the grass.”

For more on U.S. golf supply, NGF members can download the annual Golf Facilities report HERE or a one-page overview HERE. Not a member yet? We invite you to join and see what you’re missing.